Invest in Saudi Arabia

Saudi Arabia is the fastest growing and diversifying market in GCC. As per the latest world bank ranking on Ease of Doing Business, Saudi Arabia is placed at 62nd position compared to 92nd position in the year before. This drastic improvement has been the result of opening up of market to more Foreign Direct Investment, liberalizing commercial regulations to start a business and ensuring seamless online service portals for all ministries and departments.

With the relentless effort towards achieving the Vision 2030, Kingdom has attracted huge number of potential foreign investors to set up business in Saudi in the recent years. There had been steep hike in issue of foreign licenses over the past 3 years – 377 in 2017, 736 in 2018 and 1131 in 2019. More than 150 deals were signed in 2019, covering sectors from Energy to Tourism.

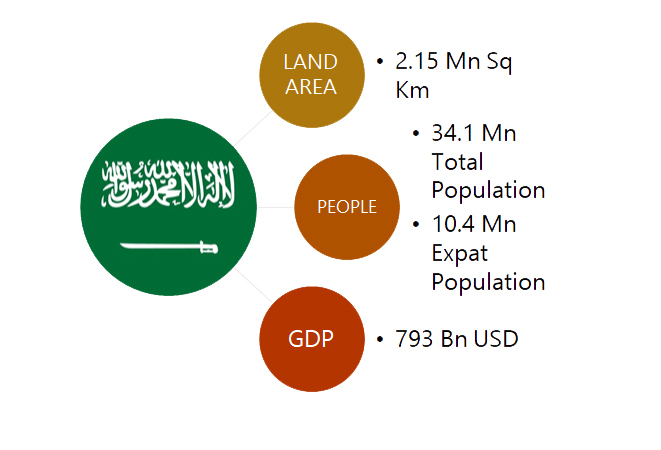

COUNTRY FACTS:

WHAT IS MISA LICENSE?

Ministry of Investments (MISA) formerly known as Saudi Arabian General Investment Authority (SAGIA) allows foreigners to hold investment licenses either fully in their ownership or in joint venture with Saudi nationals. Licenses are allowed in the following industries –

- Industrial

- Services

- Real Estate

- Trading

- Agriculture

- Scientific and Tech Office

- Economic and Technical Liaison Office

- Professional Investment

- Temporary License for Contracts

STEPS TO ESTABLISH A FOREIGN COMPANY

Foreign license can be obtained through three broad processes –

- Foreign company documentation and attestations.

- Application for MISA license

- Approval of Articles at Ministry of Commerce and Industries (MCI) and generating Commercial Registration (CR).

These processes can be further broken down into the below steps of establishing a legal foreign owned company in Saudi Arabia.

- Preparation and attestation of required documents in foreign country and in Saudi Arabia

- Foreign company activity finalization

- Name reservation and application of MISA license

- Drafting of foreign company Articles of Association (AoA)

- Getting AoA signed and approved.

- Issuance of CR

- Registration with the Chamber of Commerce (CoC)

- Register with the Ministry of Labor (MoL)

- Register with General Organization for Social Insurance (GOSI)

- National address registration

- Issue of GM Visa

Contact our offices for further guidance and information on foreign license rules in the Kingdom.